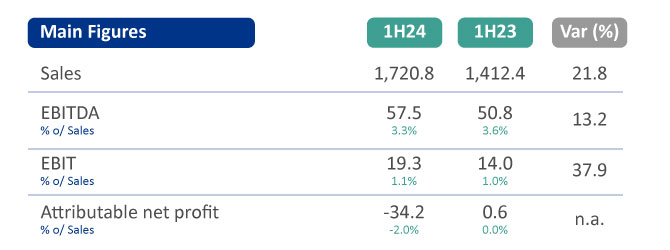

OHLA concluded the first six months of 2024 with Sales amounting to 1,720.8 million euros, 21.8% higher than in the same period in 2023, the 72.0% of Turnover was generated abroad. In the distribution of Sales by geographical area, Europe accounts for 44.3%, North America 31.8% and Latin America 23.2%.

The gross operating profit (EBITDA) is 57.5 million euros, which is 13.2% up on the 50.8 million euros recorded in June 2023. The EBITDA margin stands at 3.3%, almost one point up from the 2.5% margin in the first quarter of 2024. This improvement is due to the entry into production of new projects arising from recently concluded orders.

Operating income improved by 37.9% to 19.3 million euros. Attributable Net Loss amounted to -34.2 million euros.

Order intake and order book are the company’s pillars

Total short-term order intake in the year amounted to 2,460.2 million euros. This order intake represents a book-to-bill ratio of 1.4x. It should be noted that this parameter has increased by 62% in the first half of 2023. The total order book on June 30th, 2024 stood at 8,231.2 million euros, 5.8% up on 2023 year-end.

The construction order book stands at 6,951.6 million euros, 6.2% higher than December 2023. This portfolio is equivalent to 26.7 months of Sales. The business line’s margins are affected by the portfolio mix, which improved in the second quarter to 4.2% compared to 3.4% in the first quarter. At year-end, cash generation and profitability levels are expected to be similar to those of 2023.

OHLA’s record order intake and order backlog are two of the company’s mainstays. Particularly noteworthy during the period were the new projects awarded in Europe. In Norway, the company was awarded the contract for the design and construction of the Gjønnes Tunnel, worth approximately EUR 150 million. In Spain, the company was awarded the construction project for the last section of the Mediterranean high-speed rail corridor between Murcia and Almería, which it will carry out in a joint venture for 146 million euro

Liquidity position

OHLA ended the first six months of 2024 with a total liquidity position of 672 million euros.

The company’s gross financial indebtedness amounted to 526.9 million euros, resulting in a net cash position of 145,1 million euros.

Highlights of the year

In addition, at the end of the first half-year, the Company issued two notifications related to the divestment of the Centro Hospitalario Universitario Montreal (CHUM) and a capital increase of 100 million euros approved by the Board of Directors.

- In early June 2024, the divestment was announced of OHLA’s holding in the Centro Hospitalario Montreal (CHUM), a non-core asset whose sale is part of the company’s roadmap to reduce its indebtedness. The transaction amounts to 54.9 million euros and is expected to be closed in the last four months of the year.

- On June 26, 2024, a capital increase of 100 million euros was announced to strengthening shareholders’ equity.